Online cash loan is faster compared to normal lending financial institution or bank as such loans are available quickly and easily to solve your urgent financial needs. There is no longer a need for you to wait for weeks to get your credit history evaluated and approved. With online cash loan, or payday loan, all you need is to fill up an online application form and your money will be credited to your bank account within 24 hours. Simple isn't it?

However, before taking up an online loan for your fast cash needs, I would like to highlight the pros and cons so that you have a better understanding of it.

Advantages Of Online Fast Cash Or PayDay Loan:

However, before taking up an online loan for your fast cash needs, I would like to highlight the pros and cons so that you have a better understanding of it.

Advantages Of Online Fast Cash Or PayDay Loan:

1. Low Qualification Criteria To Get Approved

Different online cash loan companies have different sets of lending criteria yet in most cases, you only need to be at least 18 years old, have a permanent employment and have a valid bank account.

2. Bad Credit History Might Not Be A Issue

Some companies may even approve your loan if you have bad credit history or without perfect credit. It will be difficult for you if you opt to apply in banks or credit card companies.

3. Lesser Paper Work And No Fax

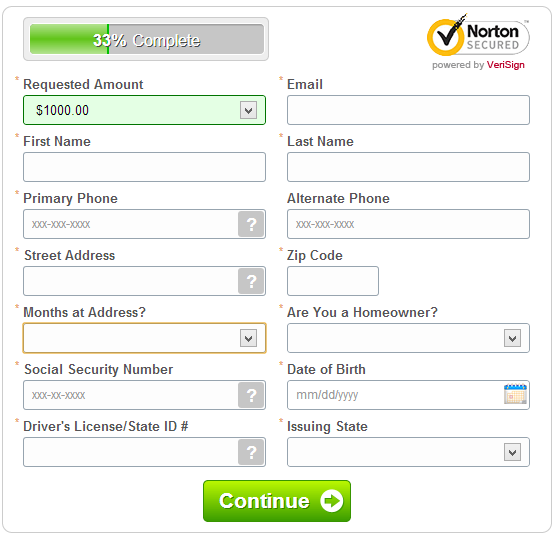

In most cases, you need not submit long list of your credentials for approval. Very little paper work will be involved since all the application process is done online. No faxing is required as well.

4. Can Be Done Online Easily

Well, since it is an online cash loan company, naturally all the application and approval procedures are done on the internet. There is no need for you to join long queues just to get a loan anymore.

Disadvantages Of Online Fast Cash Or PayDay Loan:

1. Higher Loan Interest Rates and Fees

Loan interest rates and fees charged for online cash loan are higher compared to normal loans. Interest rate is calculated in APR (Annual Percentage Rate). It is hence not recommended to use it as the first option if you are not in need of urgent cash.

2. High Late Fees If You Don't Repay On Time

It can be quite costly if you do not repay your loan on time. You need to pay late fees and this would increase your loan amount more than you can imagine. You may even ended up paying double the amount you received in advance. Hence you should plan and keep track of your repayment schedule well.

3. Short Repayment Period

Unlike traditional financial lenders which give you a term of a year or two, online cash loan companies typically require you to repay your loan within a few weeks.

4. Hidden Or Unclear Terms And Conditions

Certain high risk terms and conditions might be intentionally hidden or made unclear by some companies in the form of fine prints or whatever. Make sure you read them carefully and thoroughly.

0 komentar:

Posting Komentar