With more people relying on credit cards and creating considerable debt due to economic difficulties, it is becoming harder to save for future needs and to exercise sound financial management. Whether you have accumulated a few debts or facing a blacklisting, there are options available to assist in working towards a financially free status. Quick loan approval can be received for bad credit and payday alternatives to settle the outstanding bills.

When you accumulate debt whether on personal accounts or a credit card, it will include a high interest rate on the repayment. For many people, the interest charged is so high that it is impossible to settle the outstanding bill as you try to catch up to the repayments. This is a major contributing factor to accumulating debt leaving many with few options when emergencies strike and access to funds is necessary.

When you accumulate debt whether on personal accounts or a credit card, it will include a high interest rate on the repayment. For many people, the interest charged is so high that it is impossible to settle the outstanding bill as you try to catch up to the repayments. This is a major contributing factor to accumulating debt leaving many with few options when emergencies strike and access to funds is necessary.

There is the option to look for instant approval bad credit or regular payday loans that serve as the quickest solutions for your money related problems. Fast cash is one of the easiest ways to receive finances for emergencies particularly when things become tight until your next pay check. Perhaps you have maxed the credit card and are unable to purchase essentials for the month or need cash to settle an outstanding debt, a quick loan approval can provide significant relief.

A bad credit loan is an option that is available for individuals with poor FICO scores that require access to funds in emergency situations. Should an unexpected life event occur, you may not be able to obtain the necessary finances through conventional financial institutions. Seeking alternatives from a reputable lender can help you when facing dire straits.

Remaining aware of mistakes that have been made in he past and perhaps consulting with a financial counselor can assist in better management of your finances. Reliance on quick loans should only take place if you will be able to settle the finances on your next pay day. If you are unable to stick to responsible management practices then it may be best to avoid such options.

The payday loans are fast becoming the easiest ways to obtain cash for those with bad credit and who are simply experiencing a shortage of money for the month. There are a number of advantages provided with such alternatives as long as research into the requirements is implemented and you are aware of the fine print. Always ensure that the company you are borrowing from is reliable and reputable in the industry.

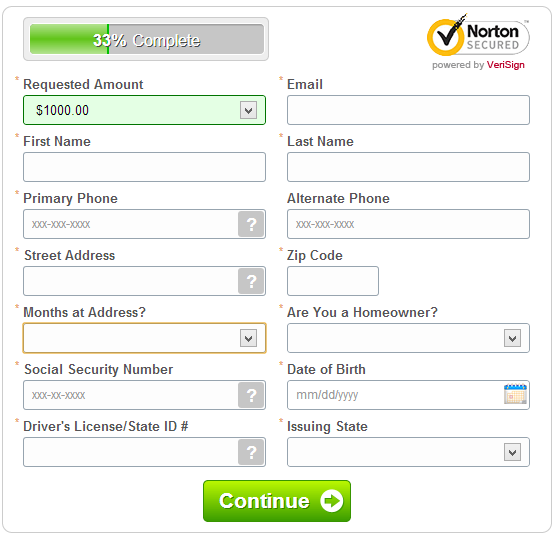

A major advantage of seeking payday loans is the speed and efficiency within which the funds can be obtained. There is the option to visit the lender or to complete an online application where you will be able to receive money straight into your bank account within a matter of minutes. With alternatives such as obtaining credit, a credit worthy test will be performed to determine whether or not approval is received.

These types of finances can be obtained without complicated processes, which means that you do not have to possess favorable credit in order to be approved. The lender will simply require information such as proof of employment, active banking accounts, and income per month. Individual checks may be performed, but this will simply determine the amount of money that you qualify for.

Quick loan approval also means greater flexibility as you will not be restricted in terms of how to spend the cash. While it is always necessary to use such finances for emergency situations and pressing financial matters, the lender will not stipulate the conditions and terms according to which the funds can be used. Exercise responsibility and manage your money to prevent from accumulating additional debts and complicating your monetary situation.

If you see payday loan lenders, ensure that the company is in fact reputable. While such options can offer numerous benefits, assess the interest that is charged on finances before rushing out to apply for loans. It is also important to take into account that such businesses will require that the borrowed sum is to be paid in full with your next salary.

0 komentar:

Posting Komentar